The term Dutch Disease is an economic term that refers to the negative consequences that can arise from a sharp increase in a country’s income, especially from natural resources like oil, gas, or minerals. It usually leads to a strengthening of the country’s currency, which makes other sectors of the economy — like manufacturing or agriculture — less competitive in international markets. This can cause deindustrialization, job losses, and long-term economic imbalance.

The term Dutch Disease is an economic term that refers to the negative consequences that can arise from a sharp increase in a country’s income, especially from natural resources like oil, gas, or minerals. It usually leads to a strengthening of the country’s currency, which makes other sectors of the economy — like manufacturing or agriculture — less competitive in international markets. This can cause deindustrialization, job losses, and long-term economic imbalance.

🔍 Origin of the Term “Dutch Disease”

- The term was first used in 1977 by The Economist magazine.

- It described the economic problems faced by the Netherlands after the discovery of natural gas in the North Sea in the 1960s.

- The gas exports led to large inflows of foreign currency, which appreciated the Dutch guilder, making Dutch manufactured goods more expensive and less competitive internationally.

- As a result, the Dutch manufacturing sector declined, despite the boom in the energy sector.

💡 Key Features of Dutch Disease:

- Resource Boom (e.g., oil, gas, minerals)

- Currency Appreciation (stronger exchange rate)

- Decline in Other Export Sectors (especially manufacturing)

- Shift in Labor and Investment toward the booming resource sector

- Economic Imbalance and vulnerability to commodity price swings

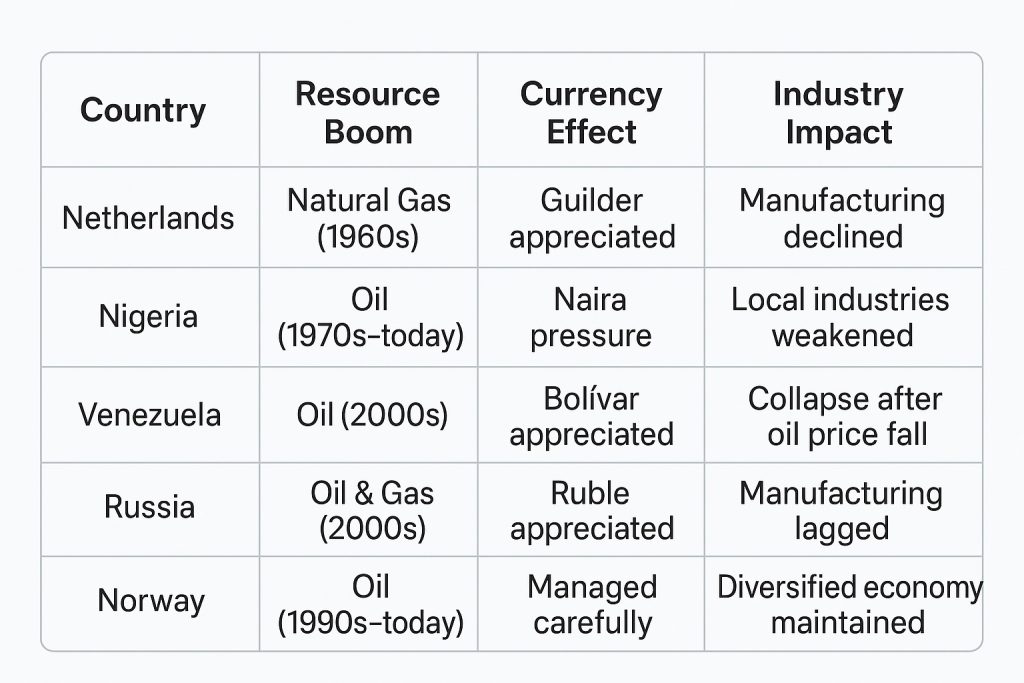

🌍 Real-World Examples:

- Nigeria and Venezuela with oil exports

- Russia (oil and gas)

- Australia (mining boom)

Great — let’s break it down thoroughly with:

- A diagram to visually explain Dutch Disease

- Step-by-step numerical examples using real or simplified data

- Several country examples with actual economic figures

📊 1. Diagram: Dutch Disease Explained

Here’s a simplified flow diagram showing the chain reaction:

Discovery of Natural Resources

⬇

Export Boom (e.g., oil, gas)

⬇

Inflow of Foreign Currency Increases

⬇

Appreciation of Domestic Currency

⬇

⛔ Exported Goods Become More Expensive

⛔ Manufacturing & Agriculture Decline

⬇

Economy Becomes Resource-Dependent

⬇

Vulnerable to Commodity Price Shocks

📐 2. Numerical Example: How Dutch Disease Works

Let’s say a country called Resourceland discovers oil.

📌 Initial State:

- Exports:

- Oil: $5 billion

- Manufactured goods: $10 billion

- Exchange rate: 1 Resourle = 1 USD

📌 After Oil Boom:

- Oil exports increase to: $25 billion

- Total exports now: $35 billion

👉 Currency appreciates:

- Inflow of dollars causes exchange rate to change from:

- 1 Resourle = 1 USD to 1 Resourle = 1.5 USD

📉 Impact on Manufacturing:

- Previously, a product costing 100 Resourles = $100

- Now, 100 Resourles = $150 in foreign markets — too expensive

- Foreign buyers switch to cheaper products from other countries

- Manufacturing exports fall from $10 billion to $6 billion

🌍 3. Real-World Country Examples

🇳🇱 Netherlands (1960s)

- Gas field discovery in Groningen

- Dutch guilder appreciated

- Manufacturing sector shrank

- Term “Dutch Disease” was coined in 1977 by The Economist

🇳🇬 Nigeria

- Oil accounts for 90% of exports, but:

- Manufacturing GDP share fell from 8% (1980s) to less than 5% (2010s)

- Currency appreciation made local industries uncompetitive

- Heavy reliance on imports for basic goods

🇻🇪 Venezuela

- Oil: ~95% of exports

- Boost in oil prices (2000s): strong bolívar

- Domestic industries collapsed

- When oil prices fell in 2014, the economy went into hyperinflation and collapse

🇷🇺 Russia

- Resource-driven economy (oil & gas ~60% of exports)

- Ruble appreciated during high oil prices

- Manufacturing sector lagged

- 2014 oil price drop + sanctions caused severe recession

🇳🇴 Norway (Managed it Well!)

- Oil-rich but avoided Dutch Disease by:

- Creating a sovereign wealth fund (Government Pension Fund)

- Investing oil profits abroad

- Preventing domestic currency from overheating